Beginning January 1, 2020, all Singapore companies will be charged 7% GST on the services they buy online from foreign-based providers.

Osome explains what to do about it and how to pay the tax. Spoiler: if you are GST-registered, your accounting company in Singapore will have some paperwork to do.

What services are in question?

It is not what service you buy that matters but from whom you buy it and how you use it. Put simply, you will need to pay GST on digital services bought from major foreign providers.

Services that will now be taxed:

- do not require a human rendering the service to you;

- cannot be used without a device or internet connection.

In short, your corporate Microsoft Office license will certainly be taxed. Marketing, accounting, and management tools may all be taxed if they match the criteria above.

Other foreign services that are subject to new GST rules include:

- Mobile apps

- Anti-virus software

- Website hosting services

- Cloud-storage services

Mind that changes only apply to large overseas service providers:

- Their annual global turnover is more than S$1 million.

- They sell at least S$100,000 worth of digital services to customers in Singapore in 12 months.

Major providers have been notifying their Singapore clients about the new order by email, so check your inbox.

How the New Rules Will Affect Your Company

Make sure all the relevant service providers are aware that your business entity is registered in Singapore. Do not submit false information — it is a serious offence.

Your further course of action depends on whether your company is GST-registered or not.

If your company is not GST-registered

The company that renders you the service will collect the tax from you and deal with IRAS, so no extra paperwork for you.

The GST will now be appearing on your invoices and will be included in the final price. So prepare to see the prices grow by 7%. For example, if your corporate Microsoft Office subscription cost S$100, it will now cost you S$107.

If your company is GST-registered

Beginning January 1, 2020, your company will need to pay GST to IRAS. It is called Reverse Charge.

Do not forget to notify your service provider that you are registered for GST and give them your GST registration number. They will not include GST in your bill as it will be on you to pay the tax.

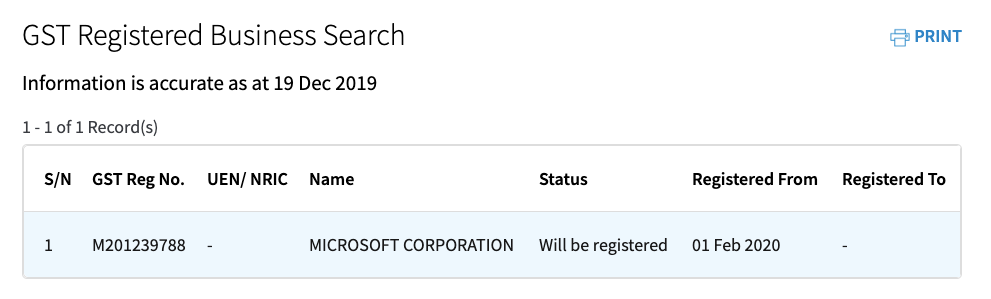

If you are not sure about the service provider’s status, check its GST registration

If your provider adds the GST charge to the invoice, but you doubt they fall under the new rules, check their GST registration on IRAS website.

If they must charge GST, they will be on the list:

Don’t hesitate to alert IRAS if you find out someone is trying to charge you wrongly.

Key takeaways

- Beginning 1 January 2020 you must pay GST on any digital service you purchase from overseas providers.

- If you do not have GST registration, your provider charges you more and pays GST sum to IRAS themself.

- If your company is GST-registered, you pay GST yourself.